what items are exempt from sales tax in tennessee

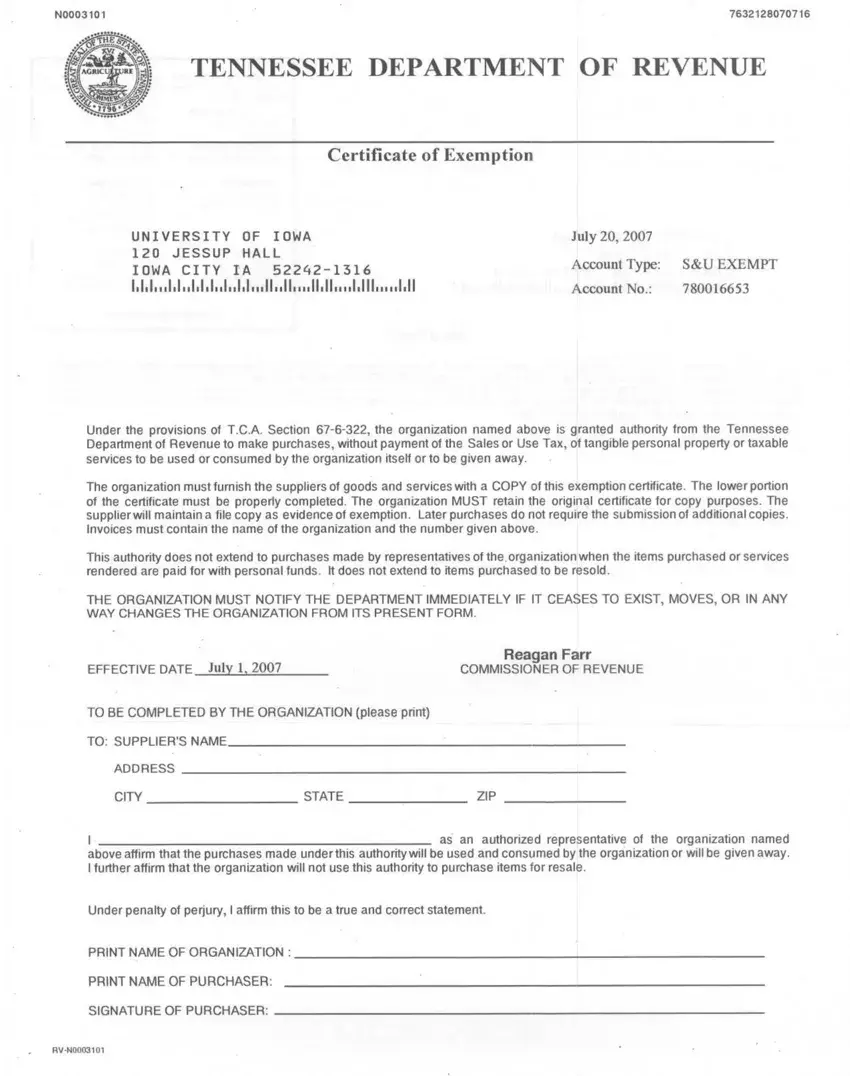

Sales and Use Tax Exemption Verification Application. Vendors are often confronted with customers who wish to make purchases tax free either because they intend to resell the item.

How Do State And Local Sales Taxes Work Tax Policy Center

67-6-228 state and local sales tax rates.

. Tennessee is one of the most retirement-friendly states in the union as Social Security benefits IRA income and all types of pension income are not taxed in Tennessee. 265 new Tennessee Sales Tax Exempt Items results have been found in the last 72 days which means that every 18 new information is figured out. If you sell any.

The umbrella that protects an exempt entity from paying taxes. Several examples of of items that exempt from Tennessee. If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along with gift information and.

If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along. Several examples of items that are considered to be exempt from Tennessee sales tax are medical supplies certain groceries and food items and items which are used in the process of. 355 new Tennessee Sales Tax Exempt Items results have been found in the last 51 days which means that every 1275 new information is figured out.

Exact tax amount may vary for different items. In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Some goods are exempt from sales tax under Tennessee.

Contractors generally owe sales or use tax on the purchase price of the materials even when contracted by tax exempt agencies or organizations. Some exemptions are based on the product purchased. For example gasoline textbooks school meals and a number of healthcare products are not subject to the sales tax.

What Items Are Exempt From Sales Tax In Tennessee. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. All state and local.

In Tennessee certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Tennessee By Eduardo Peters August 15 2022 August 15 2022 Clerical vestments golf clothing galoshes diapers swimsuits lingerie and underwear pajamas hats. June 11 2021 1419.

By Eduardo Peters August 15 2022 August 15 2022. The latest ones are on Jun 19 2022. An exempt organization pays business tax on tangible personal property it sells if gross sales exceed 3000.

2022 Tennessee state sales tax. The latest ones are on Sep 21 2022.

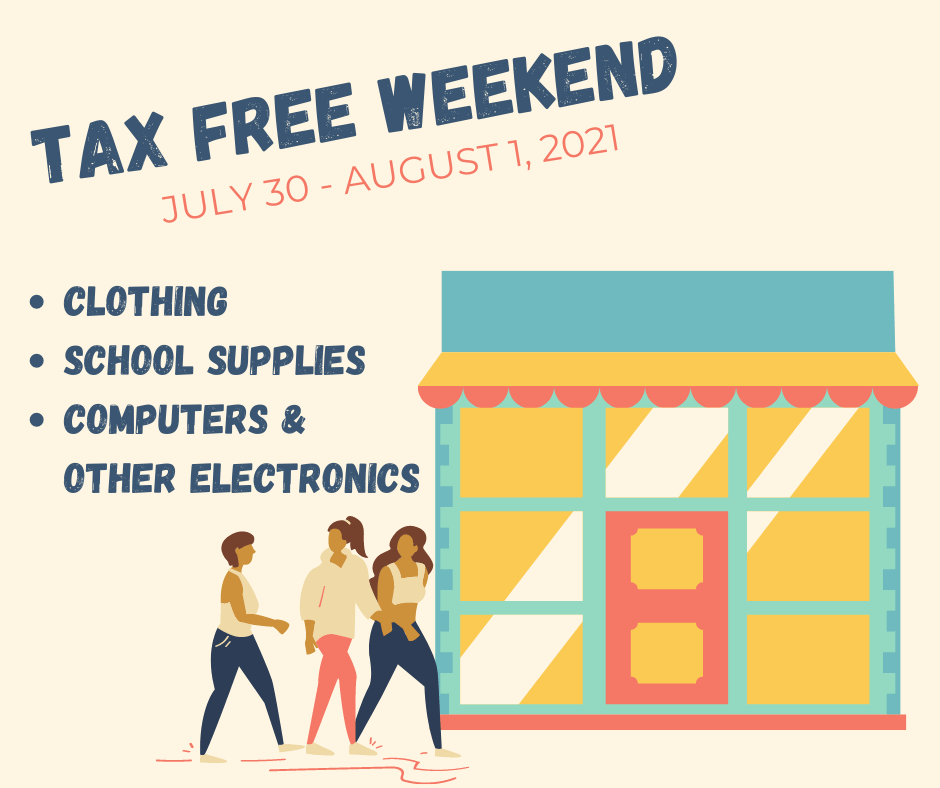

3 Sales Tax Holidays In Tennessee Wreg Com

Knoxville News Sentinel Back To School Items Like Clothing Supplies And Computers Will Be Exempt From Sales Tax Beginning Friday July 29 Grocery Items Will Also Be Exempt From Sales Tax During The

Jackson Tennessee Tennessee Tax Free Weekend

Sales Taxes In The United States Wikipedia

Tennessee Sales Tax Exemptions Agile Consulting Group

Common Tennessee Sales Tax Exemptions Youtube

Using The Tennessee Sales Tax Resale Certificate Youtube

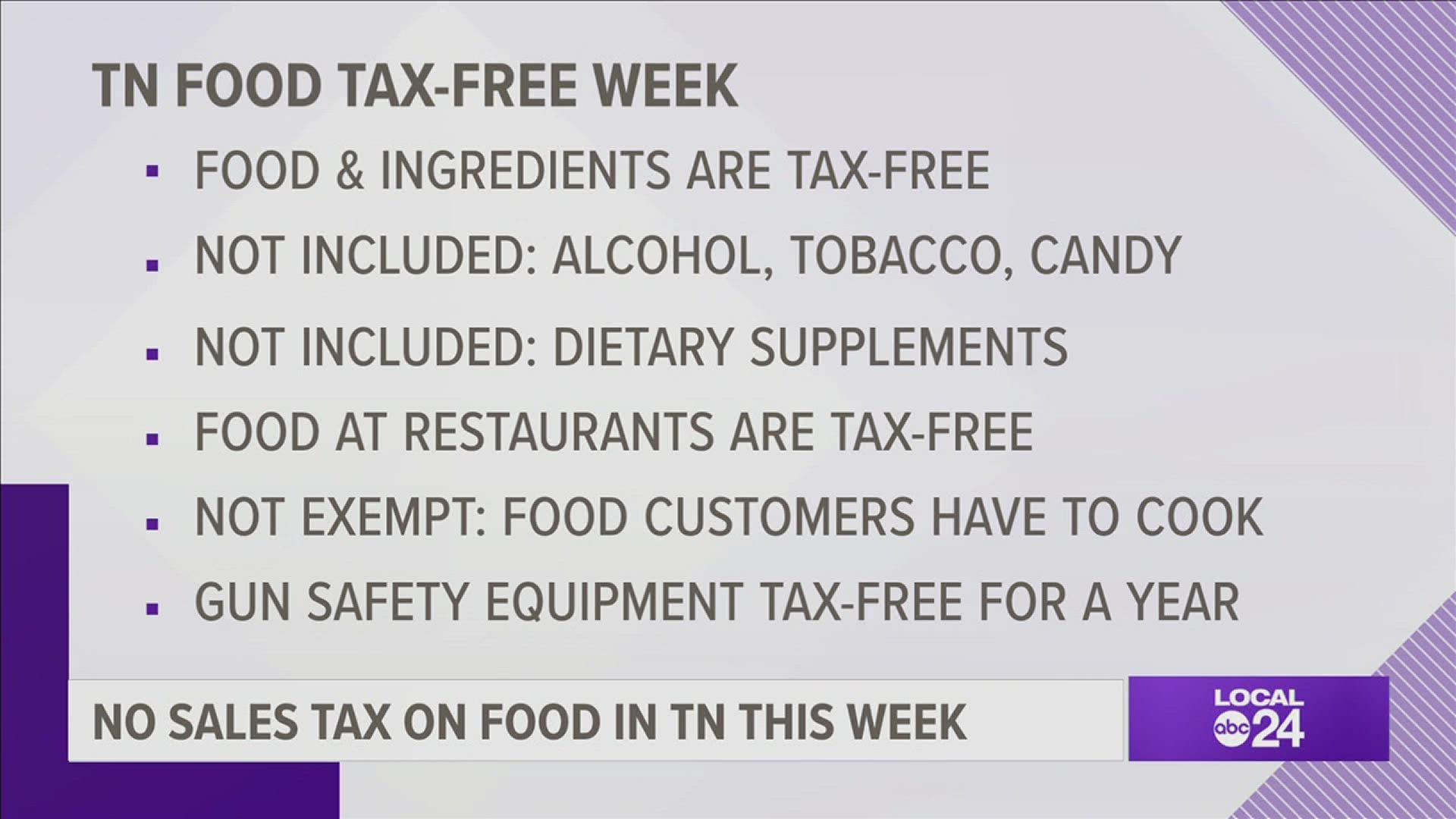

Tn Has Its First Ever Tax Free Week On Food Localmemphis Com

Ar Ms Tn Sales Tax Holidays What You Need To Know Localmemphis Com

Jackson Tennessee Tennessee Tax Free Weekend

How To Use A Tennessee Resale Certificate Taxjar

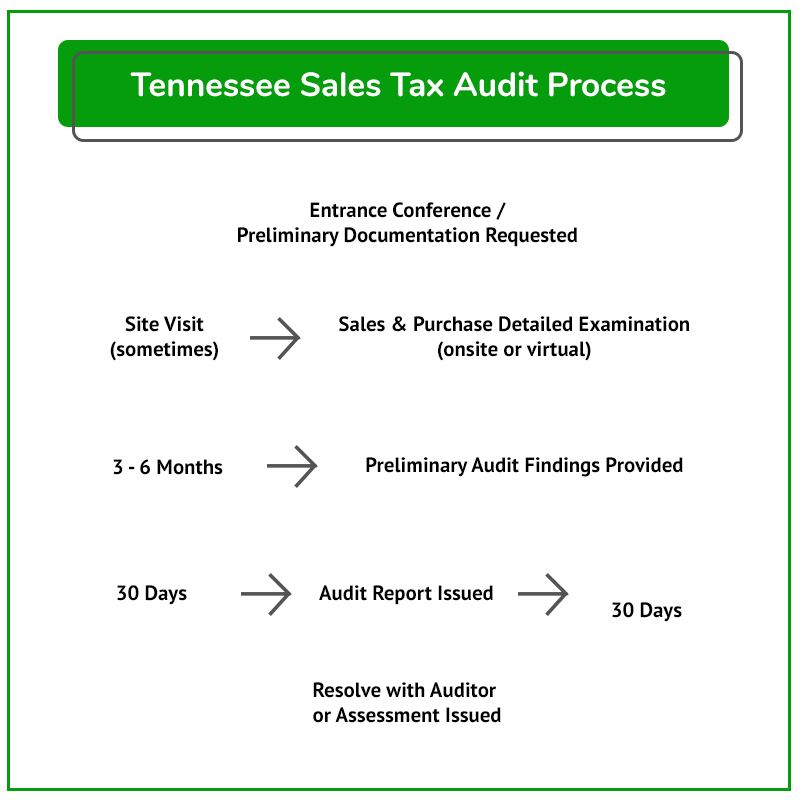

How To File And Pay Sales Tax In Tennessee Taxvalet

Tennessee Ag Sales Tax Tennessee Farm Bureau

Tennessee Exemption Certificate Pdf Form Formspal

A Monthlong Sales Tax Holiday On Groceries In Tennessee Business Johnsoncitypress Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/CEQDJLEQ3JAMTLOT4DUDSOID3A.jpg)

Three Sales Tax Holidays Coming Soon In Tennessee

Tennessee Sales Tax Guide For Businesses

State And Local Sales And Use Tax Returnsls450 Pay Online Tn Form